Why the 50/30/20 budget is unrealistic — How to budget in today’s economy

Posted by Century Support Services on Jun 13, 2022

Budgeting can be a tricky thing for many people, especially if they don’t have the time or energy to carefully keep track of each penny. The 50/30/20 rule may have been an easy simplified process for budgeting for some — especially in the past years when the cost of living was lower — but inflation and wage stagnation make the 50/30/20 budget unaffordable. Instead, try these other budgeting methods that may be more feasible.

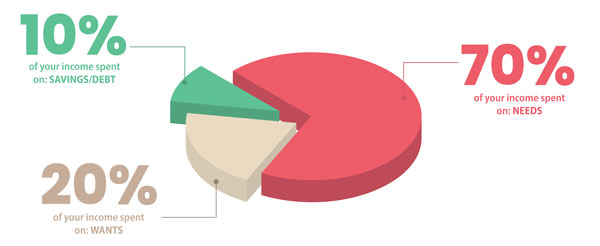

The 70/20/10 Rule

The 70/20/10 rule follows the popular budgeting method of the 50/30/20 rule that divides your monthly take-home income into three main categories: 70% for needs, 20% for wants and 10% for savings, debt or in this case, your monthly deposit into the Century program. This easy way to budget begins with mapping out the dollar amount for each category. For example, if you make $3,000 a month after taxes, you’d want to be allocating $2,100 on needs, $600 on wants, and $300 to settle your finances.

1. 70% of your income: needs.

Needs can be difficult to define for many people, but in general, include the necessities and things that you can’t avoid. This portion of your budget should cover required costs such as: like

- Housing

- Food

- Shelter

- Health Insurance

- Utilities

- Transportation

- Child care or other work expenses

As with any budgeting rule, the idea is to minimize the spending on these needs. For example, you may need to find cost efficient food options or carpool a few times a month to ensure you don’t go over 70%.

2. 20% of your income: wants.

Distinguishing between your needs and wants isn’t easy and can vary from one individual to another. Generally, wants are the extras that aren’t essential to living and working. They may include:

- Monthly subscriptions

- Travel

- Entertainment

- Meals out

3. 10% of your income: savings and debt

Devote this chunk of your income to paying down existing debt and creating a financial cushion. For Century clients, this is the deposit amount you agreed to when enrolling into your debt settlement program.

Even though the 70/20/10 budgeting method is relatively simple, some may need a more simplistic method to fit their lifestyle. If that’s you, maybe the two less restrictive rules below will help:

Zero-Based Budgeting

A zero-based budget means you assign every cent you have coming in each month to a specific purpose. Once you figure out what you need to allocate to cover expenses, savings, and debt repayment, you should have zero money left over for the month.

This method does two things:

- First, you know exactly where every dollar is going each month. So there’s no guessing

- Second, zero-based budgeting can help you avoid unnecessary or wasteful spending.

The Envelope Method

The envelope budget technique gets its name from the paper containers that help to organize your cash. It can be used with the zero-based budget method and other budgets, but it only works with hard cash. With this approach, instead of labeling a line on a piece of paper, you label an actual envelope with spending categories including must-haves such as a mortgage, doctor bills and groceries, as well as potential wants like restaurant meals, shopping and entertainment.

You’ll also have savings categories, including an emergency fund, retirement and perhaps a home down payment. Place the cash you intend to spend (online and physically) in each envelope for the month, and only spend that money on those intended items. This may help you stick to a budget better when you see where your money is going.

How Do These Fit in the Century Program?

These budgeting plans can be very helpful to manage your money while on the Century program. By setting these benchmarks for, you may be able to add additional funds to your Century program. Adding additional funds can help Century negotiate better settlements, earlier in your program, meaning you can get out of debt even faster.

However, not everyone can make use of these basic rules. Some people may need a more rigid structure to stick to the plan. Others may live in an area with exceptionally high cost of living, making the rules above nearly impossible. You may need to adjust the percentages to fit the realities of your lifestyle and locale.

Contact Century to Learn About Debt Settlement

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

To get started, you’ll receive our free assessment and our Certified Debt Specialists will create a personalized program plan for you.

To learn more about the debt settlement process or if you have any general questions relating to how long does debt settlement take or how long will it take to recover from debt settlement, we’re happy to answer any questions.

Contact us today!