Debt Relief Programs in Utah

If you are struggling to make payments on your outstanding debts, Century’s personalized debt settlement program may be able to help and is available to consumers living in the state of Utah.

According to the most recent census data, Utah’s average debt per individual ranks in the top 20 most debt-ridden states in the United States. One recent survey suggests that the average amount of individual debt in Utah is around $39,100. Many Utahns have to worry about mortgages and car payments, although credit card debt is a fundamental financial concern to those who have it as well.

What is Utah Debt Relief?

Utah debt relief helps make it easier for residents to repay their debt by either reducing or refinancing it. Programs might prioritize lowering monthly payments to make them more manageable, or reducing the total amount of debt outstanding. In some cases, debt relief programs may pursue both goals.

Generally speaking, the debt relief programs that are available can be categorized into two types of programs. There are debt consolidation programs, and there are debt settlement programs. Debt settlement is a useful tool to resolve the total amount of debt owed by making one monthly payment, while debt consolidation involves taking out one loan to pay off other debts.

Although debt consolidation reduces the number of creditors you owe by rolling your debt into one consolidated loan, the total amount of debt owed remains the same. With debt settlement, a certified debt specialist will negotiate with creditors on your behalf to reduce amounts owed and lower monthly payments.

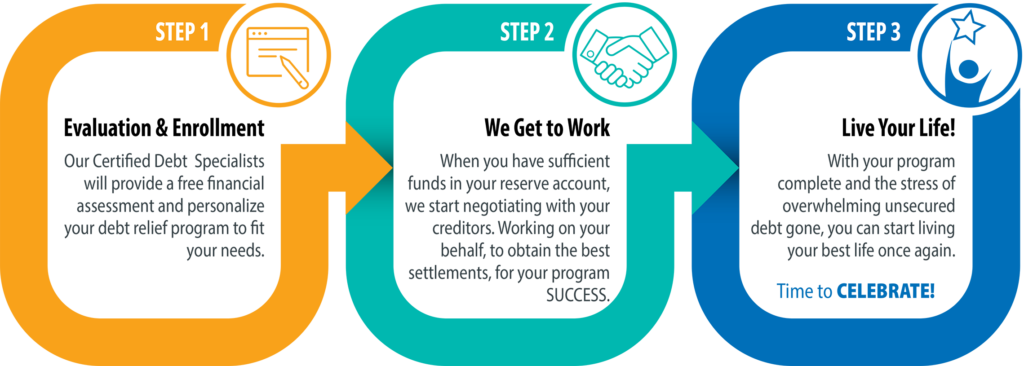

It's As Easy As 1, 2, 3 ...

Century’s focus is completely on you.

We are experienced in helping our clients get on a path toward better financial health. Check out our easy, three step program below.

Is Utah Debt Settlement Right for Me?

Choosing the right debt relief program depends on the amount and type of debt owed, among other factors. Century’s services are consistently highly rated by our customers. Our program includes such services as:

A free assessment of your financial situation

A personalized debt resolution program

24/7 online access to your account

Creditor negotiation services

Support from our award-winning team

Debt & Financial Resources for Utah Residents

Need Help Getting Out of Debt in Utah?

Century Can Help!

If you live in Utah and find that you need help with credit card or other types of unsecured debt, contact us to see if you qualify.