Debt Relief Programs in Maryland

Maryland residents who have found themselves falling into deep financial troubles due to difficulties paying off their debt realize they need to find a better solution.

A Maryland debt relief program can help them to resolve their financial struggles and get back on track to living a debt-free lifestyle. If this kind of debt struggle sounds familiar, now might be a good time to explore debt relief as a solution.

What is Maryland Debt Relief?

The Chamber of Commerce reports consumers in Maryland carry the fourth-highest credit card debt in the United States. Residents who make the minimum payment on their credit card balances are paying, on average, $11,171 in interest each year. When looking at debt from this perspective, it’s easier to see how debt can quickly snowball into unmanageable debt, especially if other types of unsecured debt are factored into a person’s financial obligations.

Just like everyone’s financial situation is different, there are a variety of debt relief programs available to help get back on a healthy financial track. Options include debt consolidation loans, debt settlement, credit counseling, debt management, and bankruptcy. Of these options, many consumers decide to go with one of the debt settlement companies licensed in Maryland.

Credit card companies won’t tell you this, but Maryland residents can have a portion of their debt forgiven through debt settlement which reduces the overall amount of money they owe. Century is very skilled at getting this accomplished.

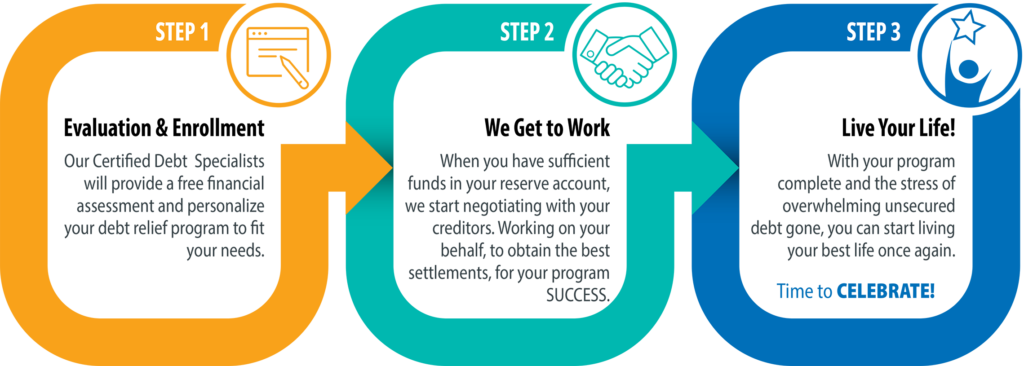

It's As Easy As 1, 2, 3 ...

Century’s focus is completely on you.

We are experienced in helping our client’s get on a path toward better financial health. Check out our easy, three step program below.

At Century, our debt settlement process is pretty straightforward. How it works is that a debt relief specialist will work with you to set up affordable monthly deposits that will be accumulated in a designated trust account. The goal is for you to make a lump-sum payment to settle your debts. As you’re building up funds, on our end, we are busy negotiating with creditors on your behalf to reduce the amount of unsecured debt you owe.

We understand there is no one-size-fits-all solution for every consumer. We work hard to ensure our clients receive the best possible solution and outcome. All you need to do is contact Century for a free, quick, no-obligation evaluation of your financial situation and we will customize a solution just for you. Once you’re approved, we’ll begin working on your behalf by negotiating with creditors to have your debts reduced.

Frequently Asked Questions about Debt in Maryland

Many consumers seeking Maryland debt settlement have many questions. At Century, we have the answers.

Debt and Financial Resources for Maryland Residents

Century Can Help Maryland Residents

Struggling with Debt

Getting out of debt is a difficult process. While it will take time, depending on your personal debt situation, Century can help ease the challenges associated with overcoming debt problems.

Our Company has been servicing clients through their debt settlements for over 17 years and our certified debt specialists are skilled in negotiation with creditors to get you a great outcome.

If you live in Maryland and need help with credit card debt or other types of unsecured debt, contact us to see if you qualify.