Debt Relief Programs in Arizona

Debt is a serious problem that affects millions of Americans. If you live in Arizona and struggle with debt, don’t try to go about it on your own. Century provides trusted and proven debt relief services for Arizona residents. If you are looking for a way to pay off your debt, we’re here to help.

What is Arizona Debt Relief?

Arizona debt relief companies offer debt relief programs that settle the outstanding principal amount you owe to your unsecured creditors. These companies have expert, experienced negotiators who work directly with creditors to allow you to pay a “settlement” to resolve your debt. The settlement is less than the full amount you owe and can be paid in affordable monthly installments. The debt relief company will have you transfer a certain amount of money every month into an escrow-like account, that you have full control over, until you have enough to pay off the settlement.

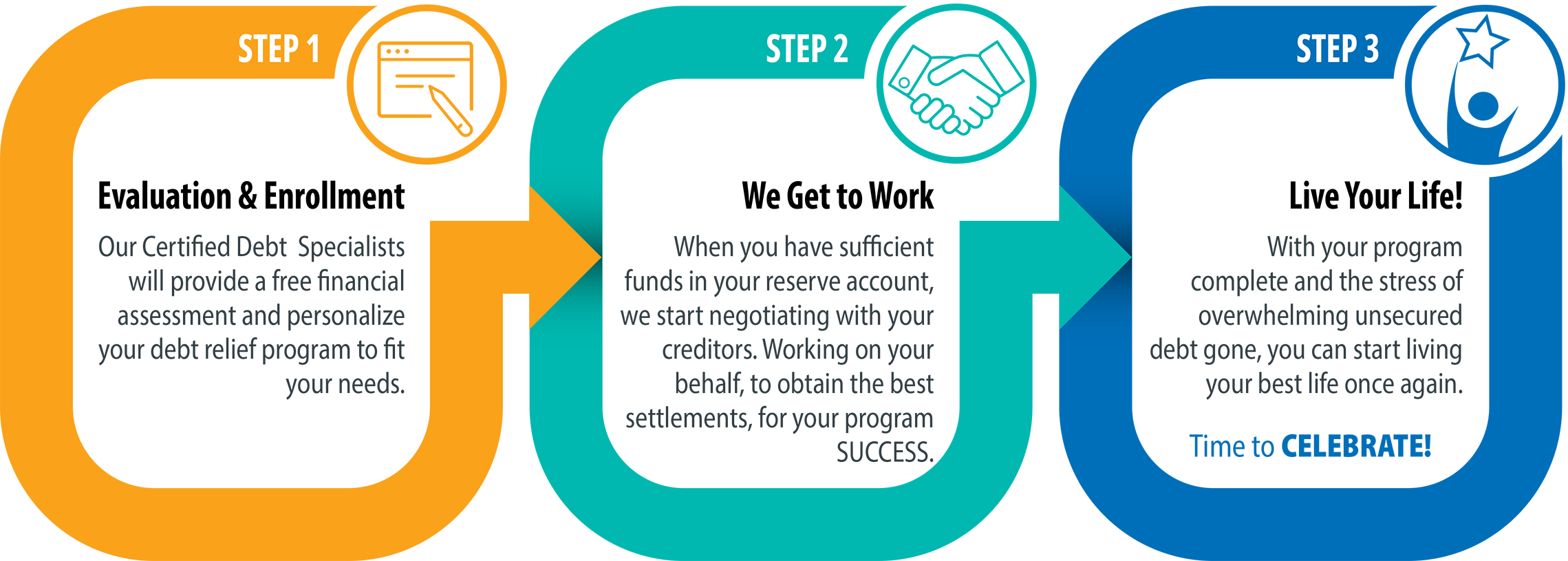

It's As Easy As 1, 2, 3 ...

Century’s focus is completely on you.

We are experienced in helping our client’s get on a path toward better financial health. Check out our easy, three step program below.

Will a Debt Relief Program Hurt My Credit Score?

With Arizona debt settlement programs, you will likely be asked to stop making payments to your creditor, while the debt relief company you’re working with negotiates your settlement. Missing payments and having past due accounts can negatively impact your credit score. However, the good news is that once your debt is settled, you can start rebuilding your credit score.

Tips for Arizonians to Stay Debt Free

Once you’ve worked to resolve your debt, following these steps can help you live within your means.

Set a realistic budget. It’s important to be proactive about managing your budget and seeing how it compares to your actual spending. Be diligent about taking the time to manage your budget and adjust it as necessary.

Avoid using credit cards. If you have to (or prefer to) use them for certain purchases, be sure you can pay off the balance quickly — ideally at the end of the month to avoid interest.

Save regularly. Set up an emergency fund and put a set amount of money into it each month until you have enough money to cover 6 months worth of living expenses. Once you reach that amount, create a savings account for larger purchases like new appliances or vacations.

For more money management tips, check out the Century resource center.

Debt and Financial Resources for Arizona Residents

Century Can Help Arizona Residents

Struggling with Debt

If you are an Arizona resident who needs help with credit card debt or other types of unsecured debt, contact us to see if you qualify.