Debt Relief Programs in Alabama

Alabama residents struggling to pay off debt might come to the realization they need to find a better solution. A debt relief program can help ease financial burdens and help you get back on track to financial freedom. If you’re having a difficult time paying your bills and finding the interest payments just continue to snowball, now might be a good time to consider enrolling in a debt relief program.

Why Consider Debt Settlement?

Alabama debt settlement is a process that stresses negotiating agreements with creditors to accept less than the full amount owed (sometimes significantly less) to legally settle a debt. This can be a viable alternative to bankruptcy and may be an especially good solution if your debts are held by debt collectors.

Century’s Certified Debt Specialists will personalize a debt settlement program based on your circumstances and support you through the next steps.

You’re a good candidate for debt settlement if you:

Have an overwhelming amount of credit card debt

Can’t afford your monthly credit card payments

Have personal loans you can’t afford to pay

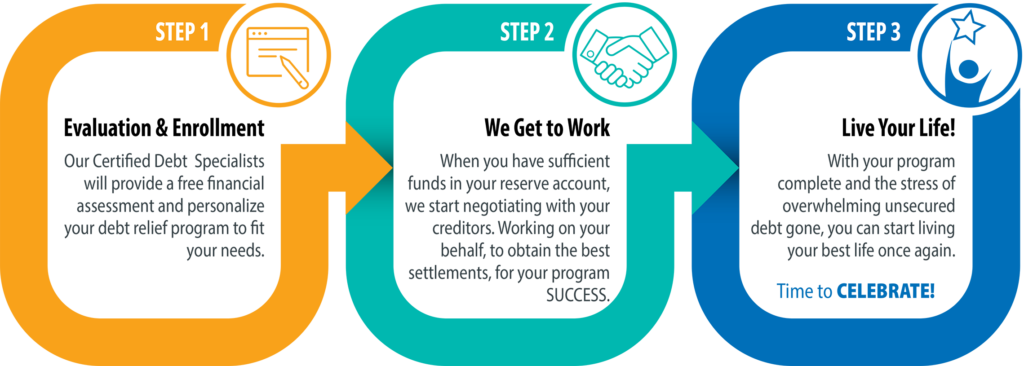

It's As Easy As 1, 2, 3 ...

Century’s focus is completely on you.

We are experienced in helping our client’s get on a path toward better financial health. Check out our easy, three step program below.

What Types of Debt Can be Settled in Alabama?

Most unsecured debts can be settled in Alabama. Because unsecured debts are not backed by collateral, they often carry higher interest rates, which can add up over time. Unsecured debts that can often be settled include:

- Credit cards

- Utility bills

- Personal loans

Will a Debt Relief Program Hurt My Credit Score?

With debt settlement programs, you will likely be asked to stop making payments to your creditors, while the debt relief company you’re working with negotiates your settlement. Missing payments and having past due accounts can have a negative impact on your credit score. Since everyone’s credit is different, it’s difficult to estimate precisely how Alabama debt settlement will affect your credit score throughout the program.

Benefits of Debt Relief

There are various benefits that come with Alabama debt relief, such as:

Settling your debts in less time

May reduce the liklihood of being sued or having a court judgment against you

Have a significant portion of your debt resolved

Settle your debts without compromising other important financial obligations

Avoid having to file for bankruptcy

Debt and Financial Resources for Alabama Residents

Century Can Help Alabama Residents

Struggling with Debt

If you live in Alabama and need help with credit card debt or other types of unsecured debt, contact us to see if you qualify.