Blogs

It all happened so quickly. When Ethan lost his job, and his wife didn’t make enough income on her own to pay their bills, they began borrowing from credit cards.

Then Ethan needed emergency dental surgery, their insurance wouldn’t cover the cost, so they also charged that expense. Month after month, they were scraping by to cover the minimum payments, but soon realized their situation was getting worse and they needed help.

Ethan found Century and talked with a Century Certified Debt Specialist. Century arranged a single monthly program deposit that was low enough for Ethan and his wife to make and get their lives back on track. And now only half way into their program, Century has settled 7 of Ethan’s 8 remaining debts. “I have had nothing but a great experience working with Century” Ethan states. “I would be more than happy to refer Century to anyone who needs their services”.

Century not only helps client’s through the debt settlement process, but also helps to educate them, so they aren’t in the same situation again. From our Newsletter tips, monthly blog articles and value-added services, Century offers many resources for financial literacy. If you are finding yourself in a situation like Ethan, contact Century today to discuss ways we can help you reach better financial health.

Congratulations on your program success, Ethan!

We thank you for trusting us to be a part of your journey toward better financial health and celebrate your diligence in staying with the program to make such great progress!

*We protect the privacy of our clients by changing their names and omitting any identifying details.

Contact Century to Learn About Debt Settlement

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

To get started, you’ll receive our free assessment and our Certified Debt Specialists will create a personalized program plan for you.

To learn more about the debt settlement process or if you have any general questions relating to how long does debt settlement take or how long will it take to recover from debt settlement, we’re happy to answer any questions.

Contact us today!

Summer brings a lot of good times, but it can also come with high air conditioning bills. You want to stay cool and comfortable during the summer, but you also want to stay within your budget. This is possible. You just need to optimize your cooling situation, so you don’t throw money down the drain. To save money on summer cooling, check out these tips.

1. Use your fans.

Fans circulate the cool air created by your air conditioner. This allows you to turn down the setting on the thermostat without reducing your comfort levels.

If you have ceiling fans, make sure they are spinning in a counterclockwise direction. Most ceiling fans can switch directions by flicking a small switch on the base of the fan. People use the clockwise direction to move hot air around their home during the winter, but that direction won’t help you in the summer.

2. Don’t use fans when you’re not home.

While an AC changes the air in your home, a fan just moves the air. By extension, fans only create benefits when people are actually in the home. To save energy, turn off your fans when you leave home or even if you move out of a particular room.

3. Get into the 80s.

Everyone has different comfort levels, but creating a home that is so cold you have to wear a sweater wastes a lot of energy. The bigger the difference between the outside temperature and your home, the more energy your AC consumes.

Most ACs can only cool your home to a maximum of 20 degrees under the outside temperature, but for efficiency, a 10-degree difference is better. Ideally, you should put your thermostat in the 80s. Research indicates that a setting of 82 degrees saves energy while also keeping your home comfortable.

4. Turn up the thermostat when you’re not at home.

In that same vein, turn up your thermostat when you leave home as well. If you turn up your thermostat, the air conditioning won’t run as hard, and you will save some money on your home cooling bill. Similarly, if you have zoned AC or window AC units, you should turn up the zones that are not in use.

According to the Department of Energy, you can save 10% on your cooling bills by turning up your thermostat from 7 to 10 degrees for eight hours per day. Over time, those savings can add up and help you get out of debt. But, don’t adjust your thermostat much more than 10 degrees. If you do, your AC will have to work too hard to cool down the home when you get home, and that will end up increasing your energy bill.

5. Invest in a programmable thermostat

A programmable thermostat allows you to set a schedule so you don’t have to manually adjust the thermostat. This ensures you never forget to change the settings when you leave your home. Contact your energy company — sometimes, they offer rebates or discounts for these energy-saving devices.

6. Keep the blinds closed

The summertime sun is great, but if it’s streaming into your home all day long, your AC will have to work harder and use more energy. Naturally, lower the temperature in your home by shutting your blinds during the day. If you want some natural light, try at least shutting the blinds on the south-facing windows that get the most sunlight.

7. Open the windows in climates with cool nights.

If you’re lucky enough to live somewhere that cools off at night, take advantage of that free cool air. During the night, turn off the AC and open up the windows. Then, before the sun gets high in the morning, close in that cold air and shut out the bright light.

For more money-saving tips, check out next month’s newsletter or look at our blogs. We’re committed to helping you live a comfortable life that doesn’t break your budget. Thanks and have a great summer!

Contact Century to Learn About Debt Settlement

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

To get started, you’ll receive our free assessment and our Certified Debt Specialists will create a personalized program plan for you.

To learn more about the debt settlement process or if you have any general questions relating to how long does debt settlement take or how long will it take to recover from debt settlement, we’re happy to answer any questions.

Contact us today!

Budgeting can be a tricky thing for many people, especially if they don’t have the time or energy to carefully keep track of each penny. The 50/30/20 rule may have been an easy simplified process for budgeting for some — especially in the past years when the cost of living was lower — but inflation and wage stagnation make the 50/30/20 budget unaffordable. Instead, try these other budgeting methods that may be more feasible.

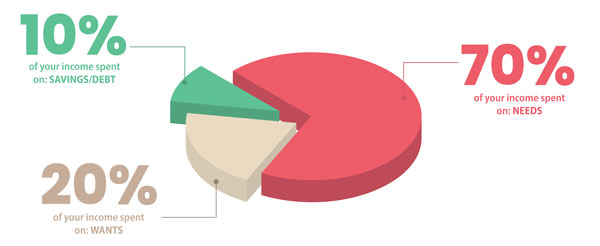

The 70/20/10 Rule

The 70/20/10 rule follows the popular budgeting method of the 50/30/20 rule that divides your monthly take-home income into three main categories: 70% for needs, 20% for wants and 10% for savings, debt or in this case, your monthly deposit into the Century program. This easy way to budget begins with mapping out the dollar amount for each category. For example, if you make $3,000 a month after taxes, you’d want to be allocating $2,100 on needs, $600 on wants, and $300 to settle your finances.

1. 70% of your income: needs.

Needs can be difficult to define for many people, but in general, include the necessities and things that you can’t avoid. This portion of your budget should cover required costs such as: like

- Housing

- Food

- Shelter

- Health Insurance

- Utilities

- Transportation

- Child care or other work expenses

As with any budgeting rule, the idea is to minimize the spending on these needs. For example, you may need to find cost efficient food options or carpool a few times a month to ensure you don’t go over 70%.

2. 20% of your income: wants.

Distinguishing between your needs and wants isn’t easy and can vary from one individual to another. Generally, wants are the extras that aren’t essential to living and working. They may include:

- Monthly subscriptions

- Travel

- Entertainment

- Meals out

3. 10% of your income: savings and debt

Devote this chunk of your income to paying down existing debt and creating a financial cushion. For Century clients, this is the deposit amount you agreed to when enrolling into your debt settlement program.

Even though the 70/20/10 budgeting method is relatively simple, some may need a more simplistic method to fit their lifestyle. If that’s you, maybe the two less restrictive rules below will help:

Zero-Based Budgeting

A zero-based budget means you assign every cent you have coming in each month to a specific purpose. Once you figure out what you need to allocate to cover expenses, savings, and debt repayment, you should have zero money left over for the month.

This method does two things:

- First, you know exactly where every dollar is going each month. So there’s no guessing

- Second, zero-based budgeting can help you avoid unnecessary or wasteful spending.

The Envelope Method

The envelope budget technique gets its name from the paper containers that help to organize your cash. It can be used with the zero-based budget method and other budgets, but it only works with hard cash. With this approach, instead of labeling a line on a piece of paper, you label an actual envelope with spending categories including must-haves such as a mortgage, doctor bills and groceries, as well as potential wants like restaurant meals, shopping and entertainment.

You’ll also have savings categories, including an emergency fund, retirement and perhaps a home down payment. Place the cash you intend to spend (online and physically) in each envelope for the month, and only spend that money on those intended items. This may help you stick to a budget better when you see where your money is going.

How Do These Fit in the Century Program?

These budgeting plans can be very helpful to manage your money while on the Century program. By setting these benchmarks for, you may be able to add additional funds to your Century program. Adding additional funds can help Century negotiate better settlements, earlier in your program, meaning you can get out of debt even faster.

However, not everyone can make use of these basic rules. Some people may need a more rigid structure to stick to the plan. Others may live in an area with exceptionally high cost of living, making the rules above nearly impossible. You may need to adjust the percentages to fit the realities of your lifestyle and locale.

Contact Century to Learn About Debt Settlement

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

To get started, you’ll receive our free assessment and our Certified Debt Specialists will create a personalized program plan for you.

To learn more about the debt settlement process or if you have any general questions relating to how long does debt settlement take or how long will it take to recover from debt settlement, we’re happy to answer any questions.

Contact us today!

If you love getting out, the month of June – National Great Outdoors Month, is a perfect time. With schools on holiday and longer, warmer summer days peaking around the corner, June’s annual summer happenings include many healthy activities.

The Great Outdoors Month, officially designated in 2019, is an expansion program of the Great Outdoors Week. The Great Outdoors Month was designed to encourage people to make healthier choices – like finding new, enjoyable, and engaging outdoor activities.

The really good news is that spending time in nature doesn’t have to be expensive. The following offers several low-cost outdoor activities that are educational and fun while providing a healthy dose of the sun’s Vitamin D.

Checkout Some Incredible Birdwatching

Public and protected lands are located throughout the United States. Depending on one’s location, some of the rarest and most beautiful birds in the world inhabit the many millions of acres of U.S.-protected land.

The National Fish and Wildlife Service offers limitless bird watching opportunities for new or birdwatching enthusiasts. With more than 560 wildlife refuges nationwide, you might just get a chance a glimpse of a condor, a puffin, a spoonbill, or the country’s national symbol – the bald eagle.

Become a Volunteer for the U.S. Department of Interior

The Department of the Interior organizes volunteers annually. Individuals donate their skills and talents to a fantastic array of national parks, cultural sites, wildlife refuges, recreational areas, and fishing hatcheries.

One of the most meaningful benefits of spending time outdoors as a volunteer is that it offers you the opportunity to give back by helping to maintain some of the most scenic locations and historically significant places in the United States.

Pitch a Tent & Find Your Spot in Nature (The Backyard Works)

The National Park Service offers some epic campsites throughout the country that are affordable and usually just a few hours of driving from most locations. Camping is a great way to disconnect from the many tempting distractions in a digital world. It is the perfect opportunity to renew relationships with yourself, nature, and other family members or friends.

If backcountry wilderness is not your thing, look no further than your backyard. Don’t have a tent? Get creative and make a teepee instead with old sheets, blankets, or a tarp. If you have a fire-pit (a bar-b-que will do), elevate traditional S’mores with this recipe.

Become Resourceful & Plan a Staycation

With just a tiny bit of planning and ingenuity, a staycation offers similar benefits to a vacation; however, it does so without the financial burden or stress (and exhaustion) traditional travel often creates.

Remember, though, the purpose of the staycation is to disconnect from a routinized life that has become overwhelming or mundane. When planning your next staycation, search for outdoor activities that will help you renew your spirit, offer a belly laugh, and provide an affordable experience that can be shared with those you love and care about. Here are a few other healthy outdoor options –

- Grab (or rent) a bike and cruise around town. Stop at your favorite ice cream shop.

- Rent a projector (laptops may work) and create a backyard drive-in with a favorite movie. Invite the neighbors and friends to enjoy the show – but don’t forget the popcorn and bug spray.

Research has shown that nature is healing, and even simply viewing nature can reduce fatigue, depression, stress, and anger – which ultimately contributes to your overall well-being. The outdoors is a great way to take care of your financial health as well, as it offers many affordable, exciting choices.

Contact Century to Learn About Debt Settlement

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

To get started, you’ll receive our free assessment and our Certified Debt Specialists will create a personalized program plan for you.

To learn more about the debt settlement process or if you have any general questions relating to how long does debt settlement take or how long will it take to recover from debt settlement, we’re happy to answer any questions.

Contact us today!

All it took was one rough year to put a real strain on Loraine’s finances. For over 15 years she worked as a traveling nurse, but once the pandemic hit she took a $5000 pay cut and her hours were cut back substantially. She was also helping with her blind, disabled mother’s care, transporting her back and forth for doctor visits and therapy. With only her income to depend on, she often found herself depending on credit cards to compensate for her lower income.

Struggling to make the minimum payments on her credit cards and the balances continuing to grow, Loraine came to the realization that it was time she sought out some help with her debt. She was hesitant at first but soon realized she made a great decision calling Century.

The Century representatives explained the program in detail to Loraine. And although she felt responsible to take care of the debts she had created herself, she trusted the experience the Century team had in handling situations like hers.

Nearly 3 years after enrolling in Century’s debt settlement program, Loraine has resolved most of her debts and is in the final stages of her last settlement!

“I’m so excited to be almost done with my debt”, Loraine exclaimed. “My program was supposed to be 48 months, but I’m getting done early!! Thank you so much, Century for making it easy!”.

Our Century representatives also provided Loraine with additional resources to help her stay focused and on the path to better financial health. Our mission is to successfully graduate our customers from their program and give them the tools necessary to take control of their financial life after Century.

Congratulations on your program success, Loraine!

We thank you for trusting us to be a part of your journey toward better financial health and celebrate your diligence in staying with the program to make such great progress!

*We protect the privacy of our clients by changing their names and omitting any identifying details.

Contact Century to Learn About Debt Settlement

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

To get started, you’ll receive our free assessment and our Certified Debt Specialists will create a personalized program plan for you.

To learn more about the debt settlement process or if you have any general questions relating to how long does debt settlement take or how long will it take to recover from debt settlement, we’re happy to answer any questions.

Contact us today!

Math is often a subject that kids either dread in school, or they fall in love with it.

But numbers matter, especially when it comes to keeping tabs on your finances. It’s for this reason and others, that the U.K. started observing National Numeracy Day, in May, and why other countries have adopted this numbers-focused day as their own. In 2022, National Numeracy Day falls of May 18, 2022.

Why Numeracy Matters

Throughout history humans have been inventing machines to help make working with numbers easier, from the abacus and slide ruler to fancy graphing calculators and supercomputers. But even with these aids, it is important to understand basic math in order to help organize your life and budget. Our skill with numbers affects not only our personal finances but the overall economy as well. All too often people leave their math skills by the wayside once they are out of school, with almost half of working adults reverting to the limited math skills of a young child.

When we don’t have a handle on basic math and numeracy skills, it is easy to lose track of what we have and what we don’t have. It’s easy to lose sight of what we can afford and run into financial trouble. Fortunately, basic numeracy and math skills can be relearned or learned better. National Numeracy provides a great opportunity to do numeracy exercises to improve your relationship with numbers and take the first steps to improve your finances.

Getting in good financial shape could be a challenge, but educating yourself and your kids, will put you and them in a position to attain better financial health

Use National Numeracy Day to Start Improving Your Numeracy Skills

Even if you thought numbers were a bit scary as a kid, one benefit of studying them as an adult is that you have a better understanding of how much they can impact your life. Doing number puzzles or even taking courses in numeracy can help you improve your skills at your own pace. The effort can be as simple as playing number-based games on your phone, or working with a tutor to get a handle on dyscalculia.

If the gaps in your math skills have left your finances a bit messy, you can also get help with budgeting and finances.

Contact Century to Learn About Debt Settlement

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

To get started, you’ll receive our free assessment and our Certified Debt Specialists will create a personalized program plan for you.

To learn more about the debt settlement process or if you have any general questions relating to how long does debt settlement take or how long will it take to recover from debt settlement, we’re happy to answer any questions.

Contact us today!

Small businesses make up 99% of all businesses throughout this great land, equating to some 31 million small businesses.

Small local businesses are synonymous with living the American Dream, making one’s own way, and being independent of large corporations.

Every year, this entrepreneurial spirit is honored when the nation collectively celebrates National Small Business Week. This year, the celebration falls from May 1 to 7. This yearly celebration highlights top entrepreneurs from every state for their contributions to economic growth and forward-thinking.

History of National Small Business Week

The Federal Government created the Small Business Administration to counsel small business owners across the land in 1953. Following this, in 1963, President John F. Kennedy created the first-ever National Small Business Week celebration, honoring top small business owners in each state with special recognition and awards. This inaugural celebration became an annual practice since that time.

Support Local Small Businesses and Save Money

Thankfully, you can help commemorate a historic celebration by honoring your own local small businesses during this week, and at the same time save a bit of money. Here’s how…

Buy Handcrafted Items

Handcrafted items are frequently part of local businesses’ inventory. This is a great benefit for you as a buyer. After all, when you are buying from the craftsman themselves, there is no middle man and very little markup. This means you can benefit from substantial savings if you are willing to buy something handcrafted instead of mass-produced. It also means you are getting an item that is individual and unlike any other product available. It is usually of much better quality as well.

Ask About Discounts

Going into a big chain store and asking for a discount on an item you want to buy would seem futile. After all, the cashier can’t change the preset cost of any item or change how it scans. This is a price set not in that store but by the corporation itself. Conversely, when you walk into a small business to buy an item, you do have the freedom to ask for a discount or maybe ask for the owner to put together a bundle of items for you at a discount.

This doesn’t mean you will always get the answer you want. Sometimes, they simply have no wiggle room on the item. However, in some cases, such as when a product has been sitting for months, an owner might be willing to negotiate the price just to move the item. Keep in mind, though, that it’s important to ask for discounts respectfully and understand if they are unable to move off their cost. If you are a regular customer, you will be more apt to get discounts as well, as loyalty to small businesses is greatly appreciated.

Buy Local Produce

Aside from clothing or home decor, local businesses can be great resources for local produce. This is because they often buy directly from local farms and then can pass the savings onto you. Not to mention the benefit you get by purchasing the freshest produce imaginable, truly from farm to table. Admittedly, this does mean you will have to buy produce that is in season where you live, instead of tropical fruits in the dead of winter. However, if you can adjust your menu to include what is in season, this can be a great way to help local businesses and save money.

Visit Farmers Markets

Not only will you gain access to local produce as mentioned above, but many artisans set up shop at Farmers Markets as well. Therefore, visiting your local farmers’ market regularly is a great way to save money on virtually any item and to help your local economy thrive simultaneously.

Keep the above tips in mind to support your local small businesses, especially during National Small Business Week. This is the ideal opportunity to give back to your community and save money as well. Happy shopping!

Contact Century to Learn About Debt Settlement

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

To get started, you’ll receive our free assessment and our Certified Debt Specialists will create a personalized program plan for you.

To learn more about the debt settlement process or if you have any general questions relating to how long does debt settlement take or how long will it take to recover from debt settlement, we’re happy to answer any questions.

Contact us today!

World Password Day might seem like just another fake holiday that someone in the IT industry created, but there’s a real focus on reminding people to protect their passwords.

Just about every day now, thousands of people are realizing their private accounts or work access has been compromised, allowing various unauthorized parties into information, assets, files and more that can literally turn a life upside down. Even worse, tens of thousands more may have no idea they have been compromised as the damage hasn’t been applied yet but their account is already opened.

Change Passwords Frequently

The easiest and most effective way to reduce password hack risk and protect an account is to regularly change one’s password at least every 90 days, and to use a complicated non-literary password. The second part is essential in blocking programs from guessing passwords. Computer bots can make very short work of literary passwords, those that use real words in some kind of combination, including names. The program simply goes through the known dictionary of all words and combinations until it guesses the right fit and breaks the password. The process usually only takes a few hours at best.

However, if one uses a password format that combines lower cap and upper cap letters, numbers and special symbols such as # or &, even the best cracking programs will take years trying to guess a password 15 digits or longer. And that’s the point of the World Password Holiday. The more people are educated on the simple steps they can take to protect themselves and their digital accounts, the less likely they will be in becoming another statistic in the news.

Passwords are meant to be secure. However, people tend to be the weakest link. If you practice easy-to-apply password safety, however, you will rest easier knowing you’re taking steps to protect your identity online.

Contact Century to Learn About Debt Settlement

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

To get started, you’ll receive our free assessment and our Certified Debt Specialists will create a personalized program plan for you.

To learn more about the debt settlement process or if you have any general questions relating to how long does debt settlement take or how long will it take to recover from debt settlement, we’re happy to answer any questions.

Contact us today!

Saving money can seem like more trouble than it’s worth, given the relatively small sums yielded by trimming expenses by a few dollars a week here and there. But take those savings and invest them, even conservatively, and that can deliver thousands of dollars over the long-term.

Try the following suggestions to cut your expenses—daily, monthly, and annually and supercharge your savings. If these long-term figures don’t boost your commitment to save, nothing will.

Daily Savings

1. Brown-bag It

A sandwich at a deli near work can cost $5 to $10 a day. That might not seem like much. But over a year, spending that every work day puts your annual expenditure into four figures. If you instead bring food from home, you can feed yourself for half as much.

While making your own lunches requires extra time and effort on your part, as you need to do the cooking and prep work at home, meals like soup and pasta can be made in large batches over the weekend. Sandwiches don’t tend to do as well when made in advance, but they’re very quick to put together before you leave for work in the morning.

If you are going to eat lunch at a restaurant once in a while, look for online deals. Restaurant.com allows you to buy restaurant certificates at a discount so that you might pay just $20 for $40 in food. If you invest those savings—of up to $35 a week, you could save about $1,800 a year!

2. Brew Your Own

Store-bought coffee has one of the highest price markups out there. You might pay anywhere from $1.50 to $2.50 or more for a hot cup of Joe from your favorite coffee shop. Want a latte or flavored concoction? Expect to shell out a minimum of $3. Buying just a single cup every day and you’ll be spending $625 to $1,000 a year—in after-tax money.

Consider that a pound of good coffee at the store costs about $15 and brews at least 30 cups of coffee. If you brew one cup a day at home, instead of buying one at the store, you’d save about $125 – $500 a year!

Monthly Savings

3. Join Supermarket Loyalty Programs

Signing up as a loyal customer at a major food chain can allow you access to member-only specials and sometimes to manufacturers’ coupons, too—the kind that fall out of Sunday papers or you download online at such sites as Coupons.com.

Most chain’s loyalty programs can save you money on two fronts – groceries and fuel. For the grocery discounts, you will need to create an online account and look at the discounts and coupons available to you based on your shopping history. The discounts and coupons will deduct when you ring up your purchases. You could save over $25 per week on groceries, which could equal out to $1300 a year.

4. Shop for Home Telecom Service

Most areas have more than one company that provides cable TV, internet, and landline services. Try calling your current provider and threatening to leave—a move that may yield some offers you won’t find on the website.

You could also save money by dropping your landline, for modest savings, or your TV service. Cutting cable or satellite TV will offer more significant savings, especially with the arrival of streaming services such as Netflix, YouTube TV, Hulu, etc. Another option is to ditch paying for TV entirely by spending $40 or so on a new antenna that allows you to receive over-the-air digital broadcasts of the major networks.

Don’t be surprised if you save more than $40 a month by switching—or at least reducing—your home telecom service. You could save up to $100 per month with some significant changes.

5. Consider Switching Mobile Services

If you’re no longer under a contract to your carrier—and you’re not paying off your phone—you might be able to switch to a less expensive network without having to buy a new phone. Most standard mobile phones can generally be used interchangeably.

Compare the extra features your provider offers such as phone insurance and data rollover as well. A plan with unlimited talk and text for a single line could cost $10 a month less with T-Mobile verses Verizon. Or opt-in for autopay which you could save $5 per line a month. Those savings could deliver over $180 a year.

Lower Your Monthly Bills!

Do you have a cell phone? Internet? What about cable or satellite TV? Just like most of us, you’re probably paying an arm and a leg for those services. Our team of savings experts will call your service providers and get you lower rates on your bills.

6. Shop for Electricity

In many states, you’re allowed to buy electricity from providers separate from the company that brings the power into your house. These alternatives often have lower rates than the utility company.

Shopping for energy is a lot easier than you might think. Once you get a few basics down in order to make an educated decision about which gas or electricity plan to choose, the rest is an easy sign-up process. Being able to choose your energy plan not only provides the ability to compare energy companies for their competitive rates, but also allows you to have a fixed-rate plan, customer perks, and exceptional customer service.

While it doesn’t sound like much, you could save between $5 and $10 a month depending on how much electricity you use. That could add up to roughly $120 a year.

Annual Savings

7. Reduce Your Insurance Premiums

Review your homeowner’s and auto insurance policies at least every year for changes that could save you money. Consolidating all the policies you hold with one company typically earns a discount of between 5% and 25% on each.

Compare your rates with quotes from different insurers. Despite strict state oversight, companies have different pricing algorithms, so shopping around should pay off. This is especially true if your credit score is low, you’ve had a recent accident, or you have an insurance claim on your record. Companies will treat that activity differently, so getting quotes from several insurance carriers is a good way to find a proper fit for your situation.

Based on pricing car insurance for a sample driver, the least expensive carriers nationally (GEICO and Erie) offered rates that were 30% below the national average for that driver and car. You could save about $450 a year!

8. Use Apps To Help Track and Save Money

A rise in both the number and the quality of personal finance apps have made it far easier to know from your smartphone or computer where your money is going, and to help you save more painlessly. Budgeting apps let you easily manage your money right from your mobile device.

These resources will help you create a budget, track your spending, connect all your bank and credit card accounts, and remind you of all your monthly bills.

The Bottom Line

You make not be able to take advantage of all of these savings strategies. Still, it’s the little actions you take that can make a big difference to your overall bottom line savings.

Contact Century to Learn About Debt Settlement

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

To get started, you’ll receive our free assessment and our Certified Debt Specialists will create a personalized program plan for you.

To learn more about the debt settlement process or if you have any general questions relating to how long does debt settlement take or how long will it take to recover from debt settlement, we’re happy to answer any questions.

Contact us today!

If you’re like so many of us, you just accept your auto insurance premium as a given. You probably even accept the fact that it increases each time the policy renews. Do you know that you may have some control over what you spend? Even though the industry is highly regulated, not all car insurance is the same.

Besides paying for auto insurance, most of you probably also need to buy other types of coverage for your home, other vehicles, and maybe even a business. You may pay insurance companies a lot every month, but you also have quite a bit of bargaining power and should not hesitate to shop around for car insurance every year or so.

Shop and Compare

You may not realize it, but it’s likely that your insurance needs have changed over the past year. Even if everything has stayed exactly the same, the insurance market is incredibly dynamic. This means that you probably should update your insurance or at least, search for better value.

Compare your rates with quotes from different insurers. Despite strict state oversight, companies have different pricing algorithms, so shopping around should pay off. This is especially true if your credit score is low, you’ve had a recent accident, or you have an insurance claim on your record. Companies will treat that activity differently, so getting quotes from several insurance carriers is a good way to find a proper fit for your situation.

Insurers offer a variety of discounts for cars with new safety features or installed safety systems. Since some of these systems come with the car, you might not even be aware of what you have. If you ask, the insurer or agent can look up your make and model of vehicle and tell you what you have.

Bundle Different Types of Insurance

Insurance companies typically offer many kinds of policies. If your policies are spread among different insurers, you may be leaving money on the table. Companies want as much of your business as possible, so they often offer discounts if you buy multiple policies. If you need both homeowners or renters’ insurance and auto insurance, you should know that many companies will offer you savings for bundling everything with them. You may also get a discount for other kinds of insurance, if your household buys multiple policies or has multiple people insured on the same policy.

To Sum it Up

Saving money is a good thing and lowering your car insurance premiums can be one way to keep a little extra in your pocket. Shopping around and comparing rates at different companies is one way to save.

Some folks put off shopping for new auto policies because they imagine it will take a lot of time or be difficult to understand their quotes. If you know what you want, you can find online quotes that can give you premium offers within seconds. Otherwise, you might simply call an independent insurance agent who can learn more about your unique situation and budget, suggest the right coverage, and then shop for you to find affordable premiums from a quality insurance company.

Contact Century to Learn About Debt Settlement

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

To get started, you’ll receive our free assessment and our Certified Debt Specialists will create a personalized program plan for you.

To learn more about the debt settlement process or if you have any general questions relating to how long does debt settlement take or how long will it take to recover from debt settlement, we’re happy to answer any questions.

Contact us today!

Alvaro and Daria were busy raising their family and carrying on with their day-to-day duties when Alvaro lost the job that he had for 18 years. With Daria being a stay-at-home mom, Alvaro was the main breadwinner for their household. After cashing out his 401K and turning to lines of credit to help support his family, Alvaro was getting them back on track. With things starting to look up, they decided it was time to follow their dream of working for themselves, so they opened their own flooring business. Although this new business was starting off on a good foot, it brought a lot more expenses.

Alvaro and Daria thought they were on a good path. Their business had been running for about 2 years and although they weren’t making a ton of money, their business was growing and they were able to cover their expenses. Then the pandemic hit in 2020. Most of their customers were unable to pay for their services and they were getting further and further behind on their bills. They both decided to get part time jobs to help cover some of the expenses, but creditors were calling and they knew they needed more help. That was when Alvaro reached out to Century. One of our Certified Debt Specialists talked with the couple about their needs and provided them with the best options for their family. After reviewing their options, Alvaro and Daria enrolled in Century’s debt settlement program.

Alvaro and Daria thought they were on a good path. Their business had been running for about 2 years and although they weren’t making a ton of money, their business was growing and they were able to cover their expenses. Then the pandemic hit in 2020. Most of their customers were unable to pay for their services and they were getting further and further behind on their bills. They both decided to get part time jobs to help cover some of the expenses, but creditors were calling and they knew they needed more help. That was when Alvaro reached out to Century. One of our Certified Debt Specialists talked with the couple about their needs and provided them with the best options for their family. After reviewing their options, Alvaro and Daria enrolled in Century’s debt settlement program.

“They [Century] were very helpful and friendly. I can always pick up the phone and call them. They answer all of my questions and always help me understand my options.” Alvaro said. “When we decided to take a settlement, they contacted us right away. I liked that the creditors stopped calling me and sending me letters every week.”

Life is getting back on track for Alvaro and Daria now that they are almost complete with their Century Program. Alvaro has kept the flooring business afloat and it’s now starting to bring in more income again.

Congratulations on your program success, Alvaro & Daria!

We thank you for trusting us to be a part of your journey toward better financial health and celebrate your diligence in staying with the program to make such great progress!

*We protect the privacy of our clients by changing their names and omitting any identifying details.

Contact Century to Learn About Debt Settlement

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

To get started, you’ll receive our free assessment and our Certified Debt Specialists will create a personalized program plan for you.

To learn more about the debt settlement process or if you have any general questions relating to how long does debt settlement take or how long will it take to recover from debt settlement, we’re happy to answer any questions.

Contact us today!

Achieving financial freedom is a goal for many people. For some, it means being able to pay bills with money left over each month or having a fully-funded emergency account. Others may want to retire early and travel. It generally means having enough savings, investments, and cash on hand to afford the lifestyle you want for yourself and your family.

Unfortunately, too many people are burdened with increasing debt, financial emergencies, spending, and other issues that prevent them from reaching their goals.

No matter how you define financial freedom, everyone can benefit with a few tips to put you on the right path.

Set Life Goals

A financial goal is any plan you have for your money. You can have short-term and long-term goals. A general desire for financial freedom is too vague a goal, so get specific. Write down how much you should have in your bank account, what the lifestyle entails, and at what age this should be achieved. Your goals should give you focus and keep you accountable. The more specific your goals, the higher the likelihood of achieving them.

Next, count backward to your current age and establish financial mileposts at regular intervals.

When you’re setting financial goals, make sure it’s the best choice for you. It’s easy to look around at what other people are doing and feel like you should be doing it too. But when we start comparing ourselves to other people, we’re playing a game we’ll never win. Put the blinders on, focus on your lane, and cross your own finish line – you’re off to a great start on your journey with Century!

Make a Budget

Making a monthly household budget—and sticking to it—is the best way to guarantee that you’re on the right track. It’s also a regular routine that reinforces your goals and bolsters resolve against the temptation to splurge.

Live Below Your Means

Mastering a frugal lifestyle by having a mindset of living life to the fullest with less is not so hard. It starts by developing a mindset in which you prioritize building a strong financial foundation of savings before you move on to spending and investing.

This isn’t a challenge to adopt a minimalist lifestyle or a call to action to throw out things you’ve hoarded over the years. Distinguishing between the things you need and the things you want is a financially helpful habit to put into practice.

Take Care of Your Health

There’s no denying the correlation between financial health and physical well-being. Data from a US study by the big banks showed that 81% of respondents found other goals much easier to achieve when their finances were in order, whilst 70% stated that good financial health had a positive impact on their physical health

In summary

These tips won’t solve all of your money problems, but they will help you develop habits that can get you on the path to better financial health—whatever that means for you. To continue learning more about ways to help you reach better financial health, click here.

Contact Century to Learn About Debt Settlement

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

To get started, you’ll receive our free assessment and our Certified Debt Specialists will create a personalized program plan for you.

To learn more about the debt settlement process or if you have any general questions relating to how long does debt settlement take or how long will it take to recover from debt settlement, we’re happy to answer any questions.

Contact us today!